Liquefied Natural Gas (LNG) Market to Hit $135.7B in 2024, Driven by Energy Security & Clean Transition

Geopolitical tensions and the need for energy security are pushing nations to diversify gas supply through LNG imports.

INDORE, INDIA, June 17, 2025 /EINPresswire.com/ -- Liquefied natural gas (LNG) market size was valued at $135.7 billion in 2024 and is projected to reach $290.0 billion in 2035, growing at a CAGR of 7.2% during the forecast period (2025-2035). The market's growth is driven by booming demand from growing Asian economies, rising gas-fired power generation, decarbonization policy measures, and growing LNG bunkering facilities. The European energy crisis, subsequent to geopolitical disruptions, has served to further developments of LNG import terminals in the continent. Moreover, nations are adopting flexible LNG contracts and investing in floating storage and regasification units (FSRUs) to safeguard energy security.The growth of the LNG market is primarily driven by international efforts to diversify energy sources in the power generation industry, investments made by nations in LNG infrastructure, geopolitical disruptions, and transitions towards cleaner sources of energy. As per the IEA's global Energy Outlook 2024-2028, global LNG production capacity would increase by almost 193 MTPA between 2024 and 2028, up from about 474 MTPA of nameplate capacity at the start of this year to 666.5 MTPA at the end of 2028. According to its assumed policy scenario, the IEA further projects that global LNG trade will be 482 MTPA by 2050.

Click To get a Sample PDF (Including Full TOC, Graphs & Charts, Table & Figures) @

https://www.omrglobal.com/request-sample/liquefied-natural-gas-market

Regional Outlook

North America is the Largest Market for LNG

North America leads the international LNG market due to the presence of several natural resources available for LNG production in nations like the US and Canada, increasing regional countries' connections for the export of energy to other markets, robust geopolitical connections of regional nations, and the implementation of facilitative policies for LNG production, trade, and export. In addition, the recent shift in policy by the US for exports of LNG is expected to support the development of LNG players in the region. For instance, in January 2025, the U.S. Department of Energy (DOE) has hold the LNG exports, continuing consideration of applications for the export of LNG to non-FTA nations, in line with President Trump's call for American energy dominance.

Asia-Pacific Region Dominates the Market with Major Share

The Asia-Pacific LNG market is anticipated to expand significantly during the forecast period due to rising energy demand in Asian nations, rising proportion of LNG imports by Asian nations like China, and regional aspirations for diversifying energy sources & GHG emissions in the power generation sector. For instance, in November 2024, TotalEnergies and Sinopec signed a sales contract for supplying 2 million tons of LNG annually for 15 years, commencing in 2028. The agreement reinforces TotalEnergies' presence in the world's largest LNG market in China following a strategic partnership agreement between the two firms.

Order Your Report Now For A Swift Delivery: https://www.omrglobal.com/buy-now/liquefied-natural-gas-market

Market Limitations and Challenges

• Price Volatility: LNG prices are extremely responsive to international events, supply-demand dynamics, and geopolitical disturbances. As different to oil, LNG does not have a standardized global pricing system, with regional centers such as JKM (Japan-Korea Marker), TTF (Netherlands), and Henry Hub (U.S.) establishing varying benchmarks. This lack of standardization results in price unpredictability and disparity. The Russia-Ukraine war, cold winters, or liquefaction terminal disruptions could lead to sudden spot price spikes.

• High Capital Expenditure (CAPEX) Requirements: The LNG business is highly capital-intensive, involving billions of dollars of initial investment along its value chain liquefaction terminals, shipping fleets, regasification facilities, and pipeline infrastructure.

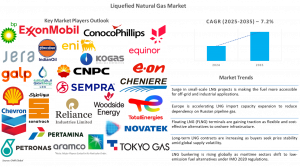

Market Players Outlook

The key players of the global liquefied natural gas market are Chevron Corp., Exxon Mobil Corp., QatarEnergy LNG, Shell Group, and TotalEnergies SE, among others. Market competitors are using partnerships, collaborations, mergers, and acquisitions approaches for business growth and new product development to sustain their market position.

Recent Developments

• In December 2024, Energy Transfer LP declared a 20-year LNG Sale and Purchase Agreement (SPA) with Chevron U.S.A. Inc. for its Lake Charles LNG project. According to the agreement, Energy Transfer LNG will provide Chevron with 2 million tons of LNG annually on an FOB (free-on-board) basis. The price will have a fixed liquefaction charge and a gas supply component that is referenced to the Henry Hub benchmark.

• In October 2024, SEFE and ConocoPhillips launched a long-term gas partnership, with SEFE agreeing to buy a maximum of nine billion cubic meters of natural gas from ConocoPhillips over a period of ten years. The deal significantly improves energy supply security for Europe and Germany. Frederic Barnaud, SEFE Chief Commercial Officer, said that "this agreement marks a crucial milestone in our efforts to diversify our natural gas portfolio.

• In September 2024, BOTAŞ of Turkey and Shell entered into a ten-year contract under which Shell will supply up to 4 billion cubic meters of LNG annually from its US and global portfolio beginning in 2027. The transaction will enable BOTAŞ to increase access to LNG by using its terminal and pipeline facilities to diversify Turkey's gas supply and support it as a regional gas hub.

• In June 2024, Oil and Natural Gas Corporation (ONGC) and Indian Oil Corp. (IOC) have signed an agreement to set up a small-scale LNG plant close to the Hatta gas field in Madhya Pradesh, India.

Inquiry Before Buying: https://www.omrglobal.com/inquiry-before-buying/liquefied-natural-gas-market

Some of the Key Companies in the Liquefied Natural Gas Market Include-

• bp Oil International Ltd.

• Cheniere Energy, Inc.

• ConocoPhillips Holding Co.

• Chevron Corp.

• China National Petroleum Corp. (CNPC)

• E.ON SE

• Eni SpA

• Equinor ASA

• Exxon Mobil Corp.

• Galp Energia, SGPS, S.A

• India Oil Corp.

• JERA Co., Inc.

• KOGAS (Korea Gas Corp.)

• PAO NOVATEK

• Petroliam Nasional Berhad

• PT PERTAMINA (PERSERO)

• QatarEnergy LNG

• Reliance Industries Ltd.

• Saudi Arabian Oil Co.

• Sempra Energy

• Shell Group

• Sonatrach Petroleum Corp

• Tokyo Gas

• TotalEnergies SE

• Woodside Energy Group Ltd

Liquefied Natural Gas Market Segmentation Analysis

Global Liquefied Natural Gas Market by Application

• Transportation

• Power and Gas Generation

• Industrial

Regional Analysis

• North America

o United States

o Canada

• Europe

o UK

o Germany

o Italy

o Spain

o France

o Rest of Europe

• Asia-Pacific

o China

o India

o Japan

o South Korea

o ASEAN Economies (Singapore, Thailand, Vietnam, Indonesia, and Other)

o Australia and New Zealand

o Rest of Asia-Pacific

• Rest of the World

o Latin America

o Middle East and Africa

Anurag Tiwari

Orion Market Research Pvt Ltd

+91 91798 28694

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.