Payments Market In 2029

The Business Research Company's Payments Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 19, 2025 /EINPresswire.com/ -- Payments Market to Surpass $1,118 billion in 2029. In comparison, the Cards & Payments market, which is considered as its parent market, is expected to be approximately $1,605 billion by 2029, with Payments to represent around 70% of the parent market. Within the broader Financial Services industry, which is expected to be $47,552 billion by 2029, the Payments market is estimated to account for nearly 2% of the total market value.

Which Will Be the Biggest Region in the Payments Market in 2029

Asia Pacific will be the largest region in the payments market in 2029, valued at $540,656 million The market is expected to grow from $315,919 million in 2024 at a compound annual growth rate (CAGR) of 48%. The rapid growth can be attributed to the growing banking infrastructure development and rising urbanization.

Which Will Be The Largest Country In The Global Payments Market In 2029?

China will be the largest country in the payments market in 2029, valued at $185,860 million The market is expected to grow from $109,809 million in 2024 at a compound annual growth rate (CAGR) of 17%. The rapid growth can be attributed to the rising e-commerce growth and rising internet penetration.

Request a free sample of the Payments Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=107&type=smp

What will be Largest Segment in the Payments Market in 2029?

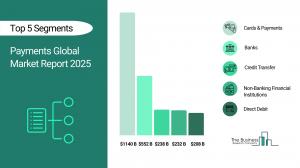

The payments market is segmented by type into credit transfer, direct debit, check payment, cash deposit and other types. The credit transfer market will be the largest segment of the payments market segmented by type, accounting for 31% or $348,841 million of the total in 2029. The credit transfer market will be supported by increased digitalization, the adoption of real-time payment systems, regulatory support for instant transfers, enhanced financial inclusion, rising consumer demand for secure and efficient payment solutions and the expansion of banking infrastructure.

The payments market is segmented by application into banks and non-banking financial institutions. The banks market will be the largest segment of the payments market segmented by application, accounting for 70% or $779,920 million of the total in 2029. The banks market will be supported by robust financial infrastructure, trust in traditional banking systems, regulatory frameworks ensuring security and compliance, widespread branch and automated teller machine (ATM) networks and the integration of advanced digital payment technologies to enhance customer experience.

The payments market is segmented by end-use industry into retail and e-commerce, banking and financial service, IT & telecommunication, healthcare, transportation and other end user industry. The banking and financial service market will be the largest segment of the payments market segmented by end-use, accounting for 25% or $277,151 million of the total in 2029. The banking and financial service market will be supported by advancements in digital banking, increasing demand for secure and efficient payment solutions, the adoption of real-time payment systems, regulatory support for financial innovations and the growing integration of artificial intelligence and blockchain technologies.

What is the expected CAGR for the Payments Market leading up to 2029?

The expected CAGR for the payments market leading up to 2029 is 9%.

What Will Be The Growth Driving Factors In The Global Payments Market In The Forecast Period?

The rapid growth of the global payments market leading up to 2029 will be driven by the following key factors that are expected to reshape commercial payments, consumer payments, and cross border transaction flows worldwide.

Rising Smartphone Penetration- The rising smartphone penetration will become a key driver of growth in the payments market by 2029. The proliferation of smartphones has significantly contributed to the expansion of e-wallets and mobile banking applications. These platforms enable users to securely store funds, transfer money, pay bills and engage in a variety of financial transactions directly from their mobile devices. As smartphone adoption continues to rise, an increasing number of users are embracing these digital financial solutions, thereby driving the demand for the payment industry. As a result, the rising smartphone penetration is anticipated to contributing to annual growth in the market.

Expansion of Contactless Payments- The expansion of contactless payments will emerge as a major factor driving the expansion of the payments market by 2029. The growth of contactless payments is reshaping the payment landscape by emphasizing convenience, security and efficiency. As the supporting infrastructure expands and consumer preferences increasingly favor cashless solutions, the payments industry is poised for sustained growth, driven by technological innovations and rising transaction volumes. As a result, the expansion of contactless payments is anticipated to contributing to annual growth in the market.

Rising Urbanization- The rising urbanization will serve as a key growth catalyst for the payments market by 2029. Urban populations, characterized by higher internet penetration and widespread smartphone usage, exhibit a stronger inclination towards e-commerce. This trend drives a growing preference for digital payments, compelling payment service providers to innovate and expand their offerings. Moreover, the advanced infrastructure in urban areas, designed to facilitate cashless transactions, further accelerates the adoption of digital payment solutions. As a result, the rising urbanization is anticipated to contributing to annual growth in the market.

Access the detailed Payments report here:

https://www.thebusinessresearchcompany.com/report/payments-global-market-report

What Are The Key Growth Opportunities In The Payments Market in 2029?

The most significant growth opportunities are anticipated in the payments and credit transfer market, the banking and payments ecosystem market, and the digital finance payments market. Collectively, these segments are projected to contribute over $510 billion in market value by 2029, driven by advances in real-time payment processing, enhanced security and fraud prevention measures, and expanding adoption of digital financial services across retail, corporate, and cross-border payment sectors. This surge reflects the accelerating shift toward seamless, technology-enabled financial transactions that improve efficiency, transparency, and customer experience, fuelling transformative growth within the broader payments and banking ecosystem.

The payments and credit transfer market is projected to grow by $132,307 million, the banking and payments ecosystem market by $274,191 million, and the digital finance payments market by $103,111 million over the next five years from 2024 to 2029.

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.